Implemented in 2017, the Goods and Services Tax (GST) is a non-discriminatory tax with its effects being seen across various sectors. As there is a lot of information published on GST at large, we believe that elaborating on its impact on specific sectors will help people better understand the implications of GST on their respective sectors. After discussing the effects of GST on the hospitality sector, we will focus on the automobile sector and the effects of GST on related business transactions and undertakings in this post.

The automobile sector is mainly comprised of commercial and non-commercial vehicles, with the former consisting of vehicles like three-wheelers, minibuses, etc. and the latter comprising of personal vehicles (including SUVs, budgeted cars, luxury cars, etc). There exist different tax slabs for both the sections and we’ll be elaborating on the same through this post.

Firstly, we’ll look at the impact of GST on the commercial vehicles category and following that, we’ll focus on the non-commercial category. Here goes:

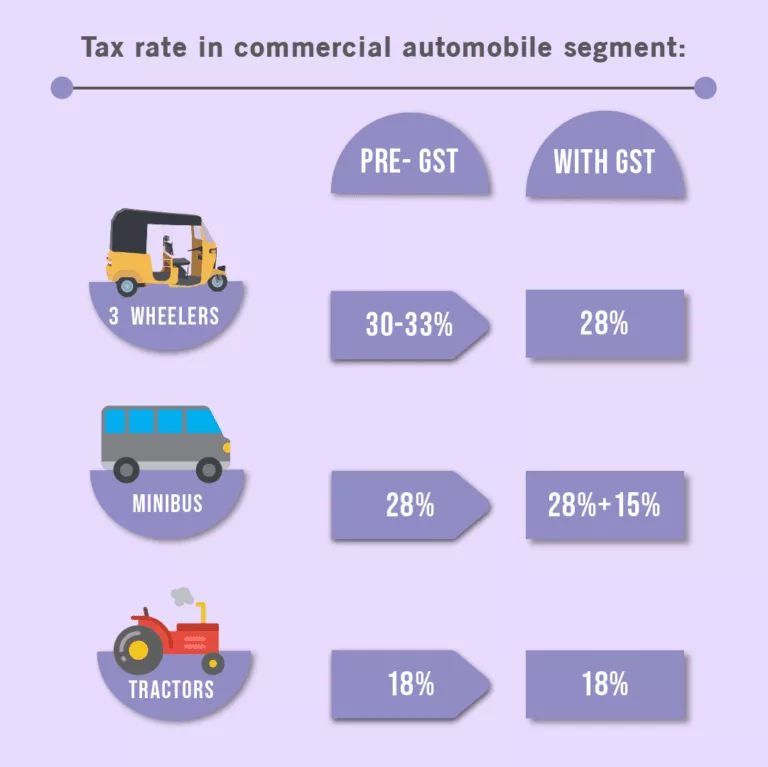

Impact of GST on Commercial Vehicles

The commercial vehicle segment, comprising of vehicles used for transportation of goods and people, vehicles used for execution of business services and three-wheelers has been heavily affected by GST. Earlier, the segment was paying 12.5% Excise Duty + 12.5% VAT and 2 % CST as well as other taxes which totalled to overall around 30-33% of tax. After the implementation of GST, the overall impact on the segment is a slight dip as the tax levied is now reduced to 28%. So, the impact in valuation is relatively negligible.

However, there would be no change in the prices of tractors. As agriculture is considered the backbone of the Indian economy, the GSTN Council (Goods and Services Tax Network) has aimed to provide major relief to the farming sector. GST tax rate on tractors and its parts has seen no change in the pre and post-GST scenario, as it continues to remain at a rate of 18%.

The maximum effect would be visible on the new category introduced, of mini-buses (buses with a capacity of carrying up to 13 seated passengers). Besides the base rate, this passenger vehicle segment would invite a 15% cess on them, which shoots up the total GST rate to 43%. This is a major cause of concern to the economy as it will not only impact businesses using such transport vehicles but also the end-consumer as their cost-of-consumption, i.e. ticket prices wherever applicable, will increase.

For example, consider a goods transport agency carrying goods from one location to another. The increased costs associated with the purchase of transport vehicles and their maintenance will inevitably inflate the selling price of goods, ultimately affecting the end-consumer. This is a major concern which the GSTN Council needs to resolve.

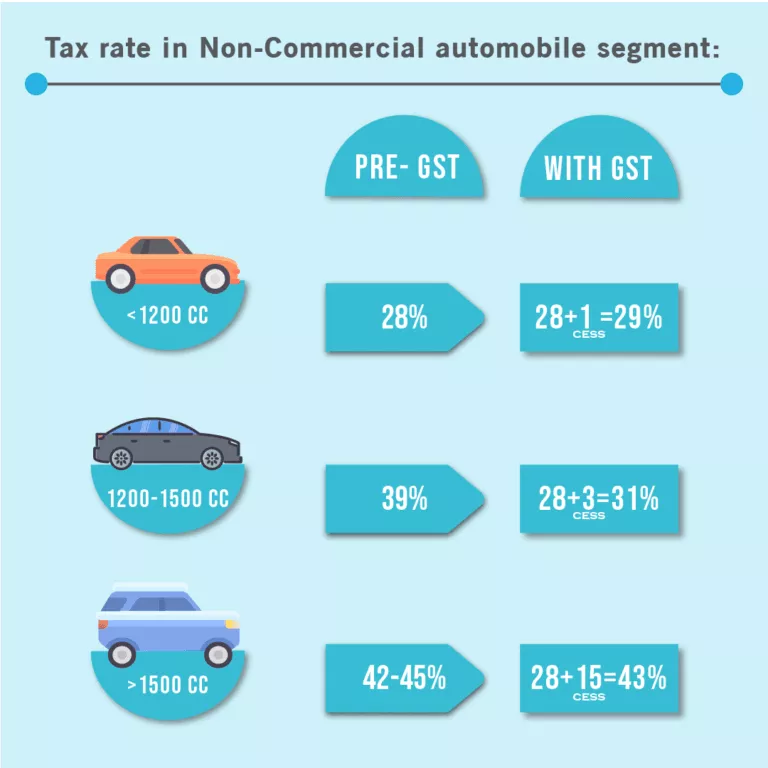

Impact on Non-Commercial Vehicles

As compared to commercial vehicles, GST has had relatively low impact on non-commercial vehicles. We’ll be elucidating its effect on small-budget cars (passenger cars costing under Rs 10 lakh), luxury cars, SUVs and further detailing how engine capacity relates to the tax rate levied on the vehicles.

-

Small-Budget Cars (Both petrol and diesel variants, costing under 10 lakh INR): This section of cars would attract the base rate of 28% GST along with a cess of 1% and 3% which is smaller than the taxes that were applicable in the pre-GST scenario which were around 30-33%. This reduction of levied taxes is very beneficial to middle class families who wish to buy small-budget cars.

-

Effect of Engine Capacity on the Tax Levied: Further, the automobile sector has tax implications based on the engine capacity of the vehicles. For example, for cars having an engine capacity < 1200cc, the GST levied will be 28% with 1% cess whereas for motorcycles/small cars/single aircraft engines or chartered planes < 1500cc, GST levied will be 28% along with 3% cess. For larger vehicles such as Sport Utility Vehicles (SUVs), etc. > 1500cc, GST levied will be 28% along with 15% cess.

-

Effect of GST on Hybrid Cars: A drawback is seen in the case of hybrid cars. With global concerns such as the rise of pollution, damage to the environment, and climate change, the GSTN council has not given importance to the sheer need for hybrid cars by levying GST tax rate of 43% (28%, with 15% cess), which is higher than the tax on smaller cars. In comparison, pure electric vehicles attract a relatively low GST rate of only 12%.

-

Effect on Luxury Vehicles/SUVs: In the recent amendment by the GSTN council, luxury cars have seen significant changes in terms of taxation. The council has increased the cess rate from 15% to 25%, escalating the total GST tax rate to 53%, which has lead to decrease of in sales in the luxury segment of the automobile sector.

The levy of GST in this segment is similar to the pre-GST scenario. Though Lok Sabha has passed this amendment, it is yet to be implemented.

Transactions Involving Transfer of Vehicle’s Ownership

Transfer of vehicles to other people will be liable for GST, irrespective of whether the transaction is intra-state or inter-state.

In the case of businesses trading in second-hand goods, valuation rules under the GST regime state that the value of supply will be the difference between selling and purchase prices. Additionally, for cases involving negative value of supply, there will be no taxable component. These aspects of GST will surely have a positive impact in this industry, because GST needs to be paid only on the difference value of the transaction.

It has been specifically provided in the valuation rules that where a taxable supply is provided by a person dealing in buying and selling of second hand goods, then the value of supply shall be the difference between the selling price and purchase price and where the value of such supply is negative it shall be ignored. This shall very positively impact this industry as GST needs to be paid only on the difference value.

Impact on Valuation

In the pre-GST scenario, the various commissions received from manufacturers such as ‘Extended Warranty’ or ‘Roadside Assistance’, Service Tax was paid only on the commission component. However, in the GST regime such tax treatment is not acceptable, and dealers will have to pay GST initially on the entire value of the warranty receipts. The amounts charged by the manufacturer can later be taken as a credit.

Conclusion

For the businesses in the automobile sector, GST has been good from a compliance standpoint. The previous state-wise compliance system has now been replaced with a single window for all compliance-related matters.

Multiple taxes have been subsumed under GST such as CST, VAT, Service Tax, Entry Tax, Excise Duty, etc. Now, corporates need to deal only with GST officers rather than going to different officers for the various tax departments.

From the Government’s point of view, it has also been beneficial because of GST revenue sharing between the Centre and States.

As the premise of GST states that it is a consumption-based tax rather than an origin-based one, it will increase the revenue of many states because the number of consumers (from States across the country) are more than the manufacturers (who are typically located in clusters in few states).

Finally, from the end-consumers’ point of view point, GST has resulted in a mixture of positive and negative impact. Because, on one hand we have an increased cost associated with commercial vehicles which consequently inflates the selling price of daily consumed goods. And on the other hand, the GSTN Council simplified the process of input credit mechanism on manufactured goods and traded goods through the Anti-Profiteering Act, thus providing relief to the end-consumers. This will encourage corporates/businesses to pass on the benefit of the input tax credit to the common man on large scale by reducing the maximum retail prices of goods.

In the non-commercial vehicle space, the varying rates based on the different categories and engine-capacities of cars has been structured bearing in mind the household incomes of different sections of society.

There are multiple future implications which an also be traced when we talk about GST’s impact on the automobile sector. A few of them are as follows:

-

The cheaper cost of vehicles will fuel their demand in the market and consequently boost manufacturing growth. Also, with the GST rates of taxation being the same across the country, there will be no differentiation of tax cost for the consumer when procuring the vehicles from another state. This will reduce incidences of tax evasion which occur due to consumers buying vehicles from the states other than where they reside.

-

With GST, things like multiple levels of taxation, elaborate tax compliance obligations and cascading taxes will be a thing of the past. A simplified and fully-automated tax mechanism will ensure better compliance.

-

With GST, things like multiple levels of taxation, elaborate tax compliance obligations and cascading taxes will be a thing of the past. A simplified and fully-automated tax mechanism will ensure better compliance.

-

Another thing to note is that GST will reduce the cost of manufacturing due to the subsuming of different taxes levied in the past. Since the taxes will be charged on supply and consumption state rather than the origin state, it would give a boost to the growth rate of the automobile industry.

-

Now with CST out of the way, the companies will not need to maintain warehouses in multiple states. This will help in consolidating the warehousing structure and can also lower down the operational costs in the supply chain. Additionally, with the inclusion of business overheads (advertising, business promotion, etc.) under ITC, operational costs can be reduced even further.

—

Written by Bharat Dhingra

Bharat Dhingra is an executive in the Financial Accounting Services team, specializing in GST-related accounting and compliances.