Key Highlights

- Infrastructure sector in India remains a key growth driver; however, it has faced quite a lot of heat owed to the COVID-19 pandemic

- Given the labor exodus, liquidity issues, stalling of project completion dates and more, one can expect tough times ahead for the sector

- There do however exist some optimists who share a relatively contrary view compared to the mainstream, one of whom is the author of this article

Shrey Aggarwal, leading Coinmen’s Tax And Regulatory Services as a Senior Manager, shares his opinion on how the infrastructure sector in India can fare during and after the COVID-19 pandemic and what can be done to ensure a smooth recovery

The infrastructure sector in India is witnessing a major shift in terms of its growth trajectory, owed to the COVID-19 pandemic’s outbreak in India. Being one of the largest growth-driving sectors from an economic standpoint, to being one of the biggest in terms of providing employment opportunities as well, this is a sector which has been the focal point of the Government’s agenda as a metric to showcase its work, boost development, and provide long-term growth for the country.

However, the fact that the infrastructure sector in India – much similar to any other country, involves a heavy inflow of financial capital as well as the use of human capital (laborers, technicians, engineers, etc.; be it organized or unorganized) means that the impact of the pandemic in this sector will be felt more compared to others.

This could mean anything ranging from slowing down of project completion, deferred dates, lower investment numbers, and paranoia among human stakeholders – all of which could inevitably see the sector going downhill in the short/medium term.

Regardless, there are those such as myself who believe that even though the common consensus paints the picture in a bad light for the infrastructure sector of India, this is a minor bump in the road and the journey ahead will be smooth. Sure, it won’t be a V-shaped recovery either – but given a time frame of 6 to 12 months, one can expect India’s infrastructure sector to get back on track.

I’ve analyzed a few points of discussion which are common opinions across the industry and given my two cents on the same in this article, covering aspects related to financial constraints, human capital, investment statistics, Government intervention, and the likely future of the sector in a post COVID-19 era.

Let’s take a look:

Perceived Performance Of The Indian Infrastructure Sector

India’s perceived performance in the infrastructure sector has come under the scanner, recently. The Government has made it abundantly clear that infra continues to be a focal point to showcase development, with heavy allocations made via the recent Union Budgets being testament to that. However, there is an eerie skepticism about the situation when it comes to allocation vs implementation.

Now while it does hold true to some extent (and parts of it have been discussed in the latter half of this article too), I think a brief run-through of the reforms in the sector as well as the kind of investments/deals that the sector has attracted would certainly indicate that there has been a consistent push in the direction to make infra a priority.

My thoughts on this would perhaps start off by looking at India as one of the world’s fastest growing economies. FDI in the infrastructure sector from March 2000 to March 2020, especially because of easing of the FEMA (Foreign Exchange Management Act) norms, has been well over USD 25 billion in the construction development sector and a similar trend has been seen in infrastructure activities – with FDI being over USD 16 billion between March 2000 to March 2020.

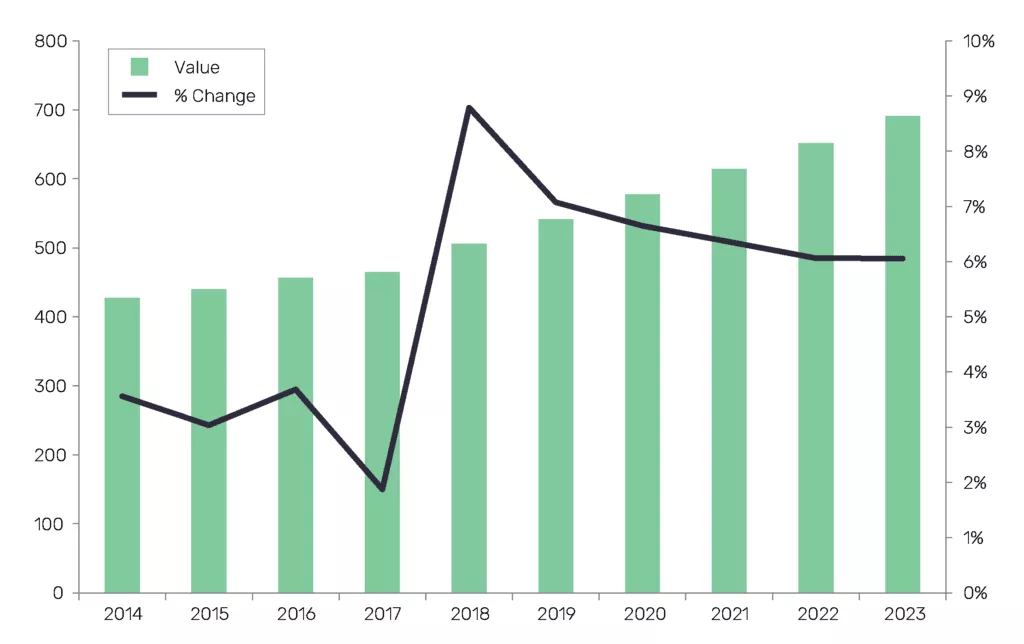

And these, with a CAGR of 7% (image shared below), simply goes to show that the pace this sector has been on has seen a consistent uptick over the past years1. Interestingly, it was only last year, i.e. before the pandemic, that the sector saw PE/VC deals touching a peak of USD 14.5 billion in 2019 as well. This shows that infra is a green area for global investors and this has been amplified by the Government’s support as well via the new and improved project modes under the PPP category which have been introduced to fast-track project development.

India, Construction Output (USD Billion) (as per 2017 exchange rates); Source: GlobalData, Construction Intelligence Center

Last year’s example of Abu Dhabi Investment Authority’s investment in GVK Airport Holdings stands testament to the rapid growth and investor interest.

Now, coming to the impact of the pandemic, this is a sector which has faced a roadblock given the size of investments and capital it attracts, but there is no doubt in my mind that this will be a short-term problem only.

Immediate Impact Of The COVID-19 Pandemic On The Infra Sector

While post-pandemic evaluations are unpredictable – given a lot of factors; there is the perception of the infrastructure sector slowing down due to obvious reasons. While the pandemic came with its own magnitude of mass hysteria, India’s population deployed as unorganized labor in the sector took to the streets – which saw a nation-wide exodus of migrant laborers.

The lockdown had noticeable impact on the output of the infrastructure sector – including but not limited to sub-sectors of construction, power, and transport. While this can be attributed to a lot of factors, the shortfall of human capital didn’t make things easier.

As there is a huge financial capital outlay in this sector, there has been a delay of projects in the lockdown, which has ultimately led to increased costs, both investment-related and operational. Even an immediate impact on valuations can be observed from the related industrial indices. For example, it can be observed that the S&P BSE India Infrastructure index lost nearly 35% value between Jan-March 20202 and the impact continues. Other than this, the transport sub-sector under infrastructure has seen significant cuts in demand all across, collections at toll plazas were minimal, power sector collections dipped by a huge margin because major consumers were only commercial or industrial.

Apart from demand and supply risk, there have been liquidity and credit issues in the sector recently. Liquidity is essential to ensure servicing of debts, payment of salaries, settlement of fables, etc.

Given that significant foreign funding has come into the sector, the burden may fall well on to the Government to implement projects under EPC mode as well as to help the domestic financing entities, at least in the short and medium term. Having said that, I would also say that it’ll be a wait-and-watch game to see how the foreign investors perceive the Indian infrastructure sector post the lockdown and pandemic scare.

Infrastructure Sector Performance During Previous Recessions

The developers and contractors are the major stakeholders within the infrastructure sector, creating long-term value for via their projects. Right now, the perception is that they’re bleeding chips and the recovery seems to be a long-term, uphill battle.

Various factors seem to be affecting this – ranging from the mass labor exodus, the slowed bankrolling of the projects, hesitation in investments, etc. And historically, whenever there has been a recession or economic downturn, the infrastructure sector has been on the brunt end of things. And I’d like to believe that regardless of the situation at and un-lockdown 3.0 being implemented from August 1, the infrastructure sector would jump into action steadily, if not rapidly.

The sector still remains highly sought after,regardless of the huge investments it requires. Given the historical examples, such as during the Great Recession during 2008-09, India withstood a heavy crisis thanks to a robust banking system and has proven before that its financing entities can steer through tough times with proper frameworks.

During the Great Recession, while the major factor which helped India steer clear from the crisis was the fact that its banks had refused to buy mortgage-backed securities and credit default swaps, it also proved that foreign investment was extremely crucial to ensure that the ship remains steady. Also, another aspect was that spending on infrastructure projects was facilitated by the banking system, especially in financing long-term infra projects.

Now, while there are also whispers of geopolitically-driven disruptions which can see various companies set up shop in India as compared to China, this can be another positive sign which indicates that the damage done will be short term only and the investors can actually look at long-term high yield from the infra sector, given its favorable valuations.

One of our clients, an export house based out China exporting to North America and Europe are contemplating to set up their operations in India instead of China and this is another example where optimism can be bet upon.

The Government Can Do A Lot More Than Just Loan Moratoriums – But What?

While it is important to keep the big picture in mind, it is equally necessary to assess “the now”. And the Government hasn’t done anything relatively significant in this regard. Some might argue that the loan moratoriums now come with deferred dates for repayment, there is no word on the compound interest problem which comes with them.

And I agree to some extent, here. This was perhaps one area which wasn’t essentially well thought through by the Government and perhaps needed more deliberation. Having said that, I feel this isn’t the end of the announcements for the sector in particular, given its critical importance to India’s economy.

So, even though lockdowns have opened up (and also been reinforced) in various parts of the country, one can understand that the paranoia regarding construction activities and the human stakeholders involved will make it relatively difficult for the construction activities to start off like they were in force before the pandemic. Therefore, it’d be a logical move for the Government to further help the contractors and developers in this regard.

Speaking purely about the deferred payments aspect, I think it’d be far-fetched to dwell on the compound interest issue. This is a sector which involves huge capital outlay, so the investors won’t look at short-term or medium-term profits. Rather, they’ll focus more on the long-term yield which the sector has the potential to bring in.

With the banking system now being revamped and being encouraged more to boost the lending in the private sector as well, this can be another green signal for the infrastructure sector in India.

Now, given the nature of the current policies of the Government which are especially catered to the infrastructure sector, especially including the tax concessions given to investors in the sector, this will always be perceived to be a high-growth area.

However, I believe the Government will have to stay aware and act swiftly to pitch in and ensure that even if there is a dip in FDI-related numbers, it has sufficient capital to provide to the infra sector players in the country.

But since the stakeholders of the sector aren’t limited to major companies and large-scale developers, it’s also important to look at the lower echelon comprising of MSMEs and SMEs, as part of the subcontractor realm. While the Atmanirbhar Bharat initiative saw dedicated care packages to combat the effects of COVID-19, implementation of the said provisions has been shrouded by various factors.

What does remain to be seen is how the investment patterns in SMEs get influenced owed to the pandemic and how they cope up, provided the construction activities don’t resume at full speed.

In all honesty, the infrastructure sector in India has suffered from a lot of roadblocks in this regard, especially when it comes to administrative measures. This includes land issues, environmental clearances, ring-fencing of projects, etc.

With the Government looking to move to EPC mode (especially given the stress that private companies had to endure to get land/land clearances), I believe it’s perhaps the only thing it could’ve done to expedite the work – even though it will involve a huge capital outlay from the Government’s pocket.

With the blockages that the sector has faced in the past, a significant amount of time and resources were consumed in managing these with the bureaucracy which ultimately led to the downtick of the overall yield of the project. This was generally seen in urban infra development, where due to the huge financial costs involved, there was a potential of sweeping away the profits.

It’s the right time for the Government to think beyond crisis management in the short term and focus on reducing process friction inward investment and ease of undertaking trans-national trade to help the stakeholders. With India’s bet to become a key player in the global value chain, now seems the right time for the Government to modernize its infrastructure and refine its economic policies.

To give an example, the Government announced the Housing For All and the Smart City Mission, and the initiatives are very much welcome; another recent announcement to set up industrial clusters out of urban cities is much appreciated as well – however, without proper implementation and frameworks in place, this may prove to be a failure.

It’s imperative that practical frameworks are laid down to help the internal stakeholders (the infra companies which are executing these projects) as well as the beneficiaries to whom these projects are directed to.

Closing Remarks / Summary

Now, to be honest, I believe the situation isn’t as alarming for infrastructure players to explore other domains to weather the storm of the pandemic. The projects with the huge investments which are already in process, the focus of these companies will be to ensure the completion of these projects ASAP in an optimum manner with minimal losses and commercial liabilities which might arise from the project contracts.

Having said that, moving to a completely different domain won’t be a great idea for the infra companies, especially because of the pandemic. Instead, they can look at intra-sector movement, i.e., a company which is into road construction can move into dam construction or civil construction, but inter-sector movement won’t happen, given their core expertise.

I’d perhaps summarize by saying that infrastructure is the backbone of our economy and given the kind of economy India is currently juxtaposed with the kind of economy it aspires to be, infrastructural development will be key for the country to boost its development.

The pandemic is a minor glitch in the system which will affect private sector funding-related numbers in the short or medium term (and I feel this will be compensated in some manner by the Government itself), but the long-term future of the sector remains bright as ever.

References:

[1] https://www.mordorintelligence.com/industry-reports/infrastructure-sector-in-india

[2] https://www.vccircle.com/how-the-pandemic-will-impact-infrastructure-sector-and-investor-valuations/