Currently, the hot topic concerning most of the businesses under the Goods and Services Tax (GST) regime is the filing of the GST annual returns and the GST audit report.

With the completion of more than one year since the introduction of GST, it’s critical to start focusing on various compliances such as input/output reconciliation, preparation and filling of annual returns and GST audit certification.

GST Audit is the examination of records maintained by a registered dealer. The aim is to verify the correctness of the information declared, taxes paid and to assess the compliance with GST.

GST audit is based on specific basis of applicability, different forms for various type of registrations, and a structure of audit procedure which we will be elaborating through this post:

1. Applicability & Timelines of GST Audit

Firstly, the question is that whom the GST audit is applicable on, for which the central goods and services tax act provides a clear provision under Section 35(5). GST Audit is applicable on every taxable person whose turnover during a financial year exceeds INR 2 Crore and he/she shall get his accounts audited by a chartered accountant or a cost accountant on or before 31st December, following the end of the financial year.

Here, turnover refers to the aggregate value of all taxable supplies, exempt supplies, exports of goods/services or both & interstate supplies, excluding the value of inward supplies on which tax is payable by a person on reverse charge basis.

Under GST audit, the taxable person is required to furnish electronically the annual return along with a copy of audited annual accounts and a reconciliation statement reconciling the values of supplies declared in the return furnished for the financial year with the audited annual financial statement.

2. Forms for GST Audit

For GST audit, the taxable person is required to file Form GSTR-9C, which is bifurcated in two parts: Part A and Part B.

Part A is the reconciliation statement which is further divided into five sections:

-

Basic details

-

Reconciliation of the turnover that is declared in the audited annual financial statement with the turnover that is declared in the annual return (GSTR-9).

-

Reconciliation of tax paid

-

Reconciliation of Input Tax Credit (ITC)

-

Auditor’s recommendation on additional liability due to non-reconciliation

Part B is the certificate to be issued by the auditor certifying the correctness of the details in Part A and the details as submitted in the annual return.

GSTR-9C can be certified under two situations; One is where the reconciliation statement is drawn up by a person other than the person who conducted the audit of accounts and the other is the case where reconciliation statement is drawn by a person who conducted the audit. The format for certification report will vary depending on who the certifier is.

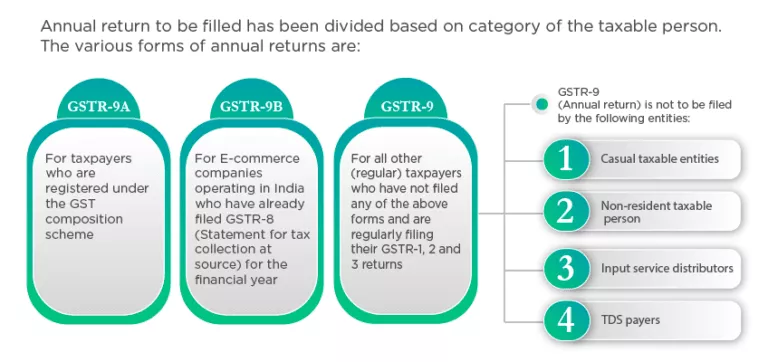

3. Annual Returns

4. Major Areas of Concern in GST Audit

Considering the various detailed reconciliations required under the Form GSTR-9C & details to be furnished under GSTR-9, lot of efforts would be required by the GST auditor and the GST auditee both, to prepare and accumulate details for these returns.

Let’s look at the areas which would require keen attention:

a) Reconciliation of GSTR-3B in relation to GSTR-1 and 2A:

The auditor needs to reconcile the gaps between GSTR-3B and GSTR 2A to make sure that the organisation doesn’t claim extra input tax credit. In case any taxable person claims extra tax credit and utilises it against the liability, then he is liable to pay interest @ 24%.

The reconciliation enables the auditor to ascertain the data gaps and recommend the management to make appropriate amendments.

b) Checking of Invoices

One of the basic tasks under GST audit is the checking of invoices. Outward sale/service invoices are checked from the perspective whether the format is correct, fulfilling all the mandatory requirements as stated under the GST rules. Also, the tax calculation and rates charged according to the service or goods in question is also a major concern.

The inward purchase/service invoices are scrutinised in order to check the eligibility of the input tax credit claimed in the return and whether the amount of the input credit as per the invoice matches with the amount of credit claimed in the GST return.

c) Reversal of Input Tax Credit for Non-Payment in 180 Days

One of the most important provisions to be audited is the non-payment of an invoice within 180 days. The auditor needs to check whether the input is reversed with respect to an invoice, against which the payment date exceeds 180 days.

If in case part payment is pending for more than 180 days, then the input tax credit to the extent of short payment would get reversed.

d) Checking Compliance with The Provisions Relating to E-Way Bills

E-way bills are important for transporting goods to the customer/buyer. The auditor is required to verify whether e-way bills were generated for:

-

Each supply having value above INR 50,000

-

Supplies made via motorised vehicles

Also, the details mentioned in the e-way bill should match with those mentioned in the invoice. In case goods are shifted without an e-way bill, the designated authority could impose fine for this.

Since GST act is a wide act which lays down various provisions with respect to different industries and services, the checks to be conducted by auditors mainly depend upon the applicability of provisions on the specific industry being audited.

Conclusion

Since this is going to be the first audit under GST, the report assumes more significance as it will be useful for references down the line. It’s important that companies should start preparing for these audits to avoid any loss of credit & applicability of interest/penalties, since all the transactions would be audited in detail.

On one side, the deadline is just a knock away from the door and all the companies have geared up for the GST audit, but still the utilities of various forms are not made available on the GST portal by the department.

On the other hand, to familiarise the auditors of the details to be mentioned in the report and the areas to be certified under the audit, the department has provided the copy of the various offline forms for GST audit and annual return.

Based on the industry recommendations to the GST Council and looking at the status of non-availability of utilities on the website, there’s a high probability that the due date for furnishing the GST audit report for the period July-March 2018 will be deferred.

GST Audit is a big milestone to be achieved by the registered taxpayers, considering that this was the first year of compliance for a tax law which has faced many hassles in its implementation.

—

Written by Aastha Berry

Aastha Berry serves as an Executive in the Financial Accounting Services practice at Coinmen Consultants LLP.

Note: Views presented in the article are of the author and not the firm.