Indian PSU (Public Sector Undertaking) banks struggle with mounting bad debts with no signs of respite even with the new NCLT (National Company Law Tribunal) window in place coupled with stories of banking frauds making headlines every other day, the obvious questions for India Inc. is –

“How will the future growth of businesses be funded, and what options are available to them?”

While the equity markets may appear to be buoyant, the road to equity markets in India is still for the privileged class of high rated borrowers (AA & Above). SME (Small and Medium Enterprises) and emerging Corporates continue to rely heavily on bank debt to fund their working capital and capital expansion needs.

Private sector lenders, barring a few, have always stayed away from funding large infrastructure projects or long-term projects; and thus, a major thrust has always come from PSU banks. Now that PSU banks reel under issues of corruption, fraud, and capital constraints there are not many options available to average-rated borrowers.

Although NBFCs (Non-Banking Financial Companies) could have captured a substantial share of the bank-credit market, their focus has been on the retail credit side or high yield, heavily collateralized borrowers which is not the norm and can never be a basis to push growth and expansion in real sense thus unable to fill the void on industrial credit.

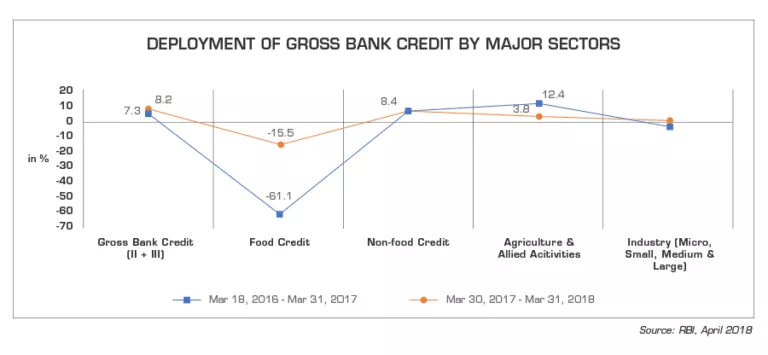

As can be seen in the image below, data from the RBI (Reserve Bank of India) on sectoral deployment of credit clearly shows the deceleration and stagnancy presently being seen in industrial credit.

As we stand today, the structural changes being carried out in terms of bad assets resolution, the proposal of opening the capital markets to “A” rated & above borrowers, and rationalization in the definition of MSME (Micro, Small and Medium Enterprises) are likely to have positive impact in the medium-term although the short-term pain might prevail. RBI’s zero tolerance towards a single day default and system of SMA (Special Mention Accounts) reporting is also likely to bring in a much-needed credit discipline; although that too may have a short-term adverse impact in terms of lenders shying away in taking credit decisions on SMA borrowers for any reason.

For the interim the choices remain largely around Commercial Papers, Debentures, and Equity markets for the high rated borrowers looking for cheaper sources of funds and the MSME and retail credit will have to depend on private sector lenders & NBFCs for their needs who are likely to strengthen their position further.

It would be heartening to see PSU banks back in action with some major overhaul to cover systemic risks and clear the rot of bad debts at the earliest in the good interest of all; but that would be a long and arduous task and will need concentrated efforts from bankers, enforcement agencies and the Government. More importantly, the media will also have a responsible role to play by not highlighting every default as a fraud; because market sentiment is easily driven or shaken by the news publicized!

—

Written by Amit Pandey

Amit Pandey is the Director of the Transaction Advisory Services practice at Coinmen Capital Advisors.