The infrastructure sector in India has become an important metric for the economy, be it in terms of assessing development, generating employment or improving the quality of life for the citizens.

The current Government of India, under the stewardship of Hon. Prime Minister Shri Narendra Modi, has given special emphasis to this sector in recent times and with the existing mandate of the government, the focus will remain unchanged for the near future. With various government-funded infrastructure projects in the pipeline such as the Bharatmala Project, S, Bullet Train Project and the NextGen Airports for Bharat (NABH) Nirman, the paramount focus of the government is clear as it plans to target long term development with a holistic approach.

Planned Growth Of The Infrastructure Sector By The Government:

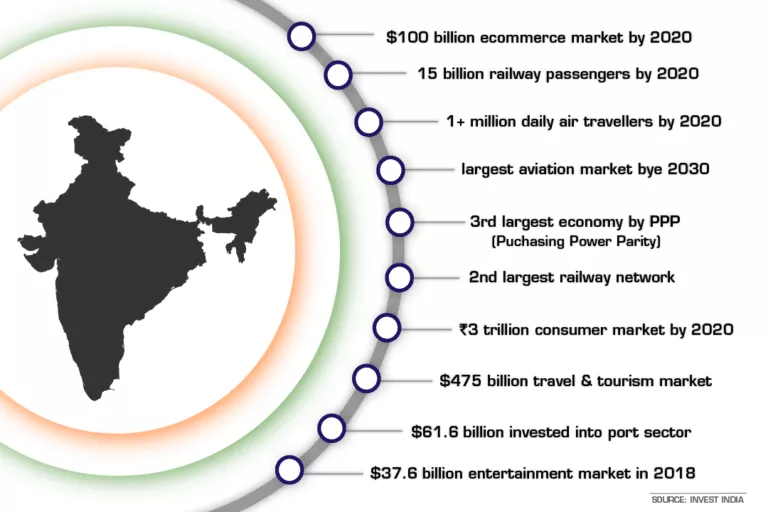

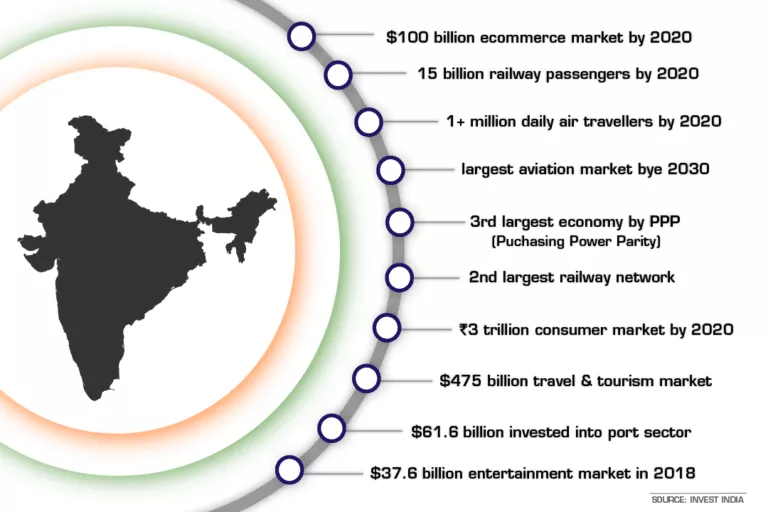

The growing need to promote sustainable development in the country has laid even more emphasis on the infrastructure sector, with India needing an estimated investment of $777.3 billion to make sure that it is fully capable of sustainable development by 2022.

The government has made further announcements in the Union Budget 2018-19 by allotting $92.22 billion to the sector for the current financial year, with a long term aim of developing smart cities (allocation of $31.81 billion), better railway infrastructure (the highest ever allocation recorded at $22.81 billion) and alternative energy source-based projects such as the $648.75 billion investment in the Green Energy Corridor Project.

Not only this, the underdeveloped North-East areas have been considered for massive development as well by the Government of India, as the India-Japan Coordination Forum for Development of North East has been further put into planning to ensure a holistic approach towards development.

Interest From Other Countries In Doing Business In India:

With various opportunities and projects already in place, one can expect the potential growth of the infrastructure sector to increase significantly in India and generate stellar revenue and employment avenues. As reported in an article by The Economic Times:

“The Thailand based companies see good opportunity here and are looking to invest around USD 3 billion by 2020. The fast–growing Indian market remains attractive for Thai investors given the opportunities in green and brown field projects including energy, infrastructure and metals,” said the Thai Trade Center executive director and consul Suwimol Tilokruangchai.

The fact that companies from different parts of the world are looking to invest in the infrastructure sector in India indicates that they are looking at our nation as a highly potent market.

Getting Started on How to Enter The Indian Market:

The reason why the infrastructure sector is looked up to with interest is because of the different types of setups in place for foreign companies to do business in India and the necessary processes for the same. These processes essentially range from ideation of the project, documentation and filing, contractual agreements and lastly, setting up a brick-and-mortar office for the companies in question.

These opportunities call for the need of certain structures in place which can closely monitor the companies’ EPC process, not just till their business is operational but even after the post-implementation procedures. Other avenues to handle issues international tax disputes, regulation, auditing, practical challenges, etc. should be put into place, as well.

A foreign entity has the following challenges to address while entering into an EPC/turnkey contract in India:

The infrastructure sector is now becoming a serving one in its nature, as the Government itself is paving the way for various investments and providing the ease of facilitation for concerned projects to foreign companies. Infrastructural advancement is surely accelerating at a lightning pace and moving towards a highly lucrative future. As we move further into this series, we shall be focusing on the intricacies of EPC contracts in our next article.

—

Written by Nupur Sharma and Kunal Arora

Nupur Sharma is a Manager and Kunal Arora is a Consultant in the Tax And Regulatory Services team at Coinmen Consultants LLP.