The new record of highs being set by the Indian stock markets has given a lot to cheer for the investors, but the bull-run is not without fears of a correction/sharp rebound as the broad economic indicators continue to give signals of increased stress. As the chain of highs continues, we look at other indicators which could spell doom for the markets down the line.

The stock markets’ buoyancy is difficult to explain with the present free-fall of the Indian Rupee, adverse crude oil movement, widening current account deficit, and inflationary pressures of uncertainty around the upcoming elections in 2019.

The graphs below showcase how the different indicators mentioned above have behaved over the last month:

1. Movement Of BSE SENSEX Over The Last Month

Source: www.tradingeconomics.com

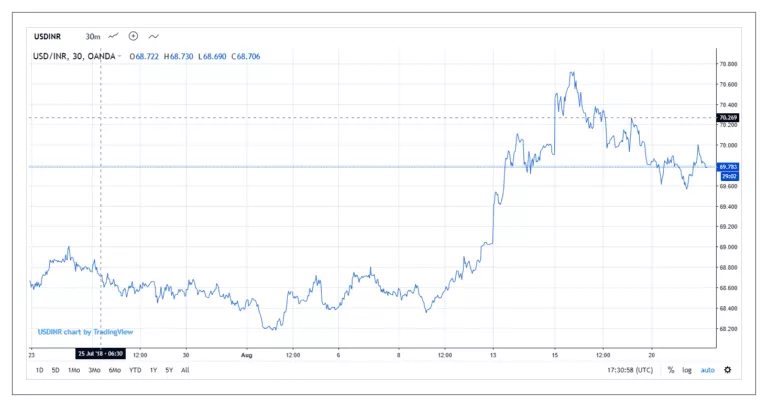

2. Movement Of Indian Rupee Vs Dollar Over The Last Month

Source: www.tradingeconomics.com

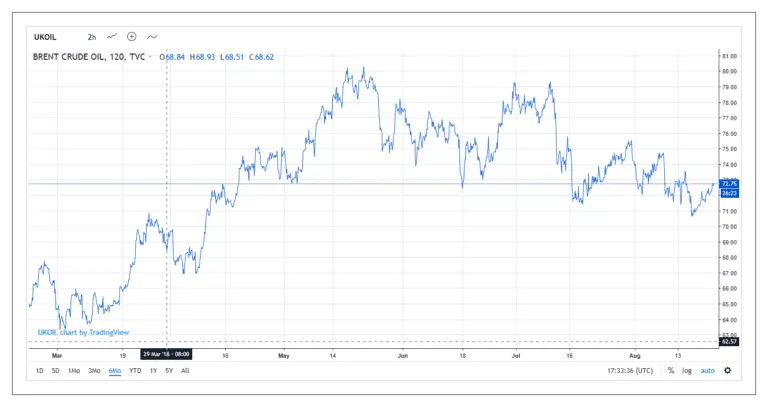

3. Brent Crude Price Movement Over The Last 6 Months

Source: www.tradingeconomics.com

Widening CAD, Weakening Rupee and Hangovers of GST and Demonetization

As a nation we import more than we export, and the adverse change in crude prices has widened the current account deficit (CAD). According to latest report from Nomura, the CAD is likely to widen to 2.8% vis-à-vis 1.9% in previous fiscal. The biggest challenge is to fund the balance of payment which is ideally funded by Foreign investors (FIs) but unfortunately what we have witnessed is a sharp pull out by FIs from our stock and bond markets that are valued at an estimated $ 9billion); and thanks to the depreciating value of the Rupee, therefore further weakening the confidence in Indian markets.

It has already widely been discussed that the dual impact of GST and demonetization has had various adverse ripple effects over the economy. To add to those woes, the financial services sector, especially the PSU banking system that has largely acted in the past as the engine to boost credit offtake and thus capital formation, is in a mess with no visible signs of recovery any time soon.

The obvious question which strikes then is – “what is driving the stock markets to new highs every day? And how long will this bull-run continue when all other economic indicators spell trouble?” Are we staring at a bubble which would once again ruin the trust and confidence of the common-man or are the markets cheering the fundamental changes and presumes the present distress to be only teething problems? Well, no logic works when things go wrong but largely the rationale being presented for this buoyancy in the markets is the presence of excess liquidity along-side confidence in the present Modi Government. Excess liquidity could be due to low capital investments by the industry and movement of Indian households from conventional saving schemes and fixed deposits to the more lucrative SIPs. Global factors such as the easing of trade war fears have also contributed to this bull-run lately.

I may only be as good as a primary school kid when it comes to studying and analyzing the behavior of stock markets; and the Gyaan (knowledge) above is all out of some curious readings over the period of latest boom. My simple contention and fear come from the routine interactions I enter with my SME/MME clients who are not blue-chip organizations but emerging corporates who claim to be facing one of the toughest & longest slump cycles during their tenures of doing business, and the mood is somber if not negative. The “wait & watch” button has remained pressed for a bit too long for smaller businesses to survive and there is an urgent need to refresh and reboot. Irrespective of how l long the bull-run continues, unless the investment cycle is corrected, and private sector comes back with confidence to invest and start new projects the targeted GDP growth is unlikely to be achieved and thus it would only be a matter of time before markets start correcting themselves.

An Uncertain Future

It is difficult to predict how much time the industry will take to get over the pains of demonetization and GST, and by when our PSU banks would come out of their slumber and start lending activities to help the industry come back on track. For now, as per the India Ratings report of August 2018, exports in India grew only by a meagre 1% during FY14-18 as against 25% during FY04-08. Gross fixed capital formation slowed down sharply to 5.4 per cent during FY14-18 against 16.2 per cent during FY04-08. Thus, the façade of a buoyant and booming market does not protect us against the inherent risks of a slowing economy and troubles being faced by other emerging markets (Turkish economy being the latest one).

It would have been much better if the Indian Elephant also ran (IMF’s statement on Aug 08, 2018: Indian economy is a like an elephant that is starting to run) along with the present bull-run in our stock markets. Let’s see what the Modi Government has in-store to shore up its popularity in the next 6 months before the curtains fall.

—

Written by Amit Pandey

Amit Pandey is the Director of the Transaction Advisory Services practice at Coinmen Capital Advisors