The Indian Government has brought about significant changes in its tax policies to facilitate ease of doing business in India. Last year, the World Bank’s “Ease of Doing Business” report ranked India 100th out of 190 countries. India jumped 30 places over the previous year’s ranking. Continuous positive efforts such as ease in compliances, digitization, the introduction of GST, introduction of e-assessments, etc. made by the government for providing various businesses the ease of doing business in India.

However, litigation in India has always been a sore point for new and existing businesses. Typically, litigation in India is multi-layer in nature and involves a lot of money and man-hour consumption. Due to a huge amount of pending litigations, a case may take up to approximately 7 to 8 years (variable) to reach a final judgment at the Tribunal level.

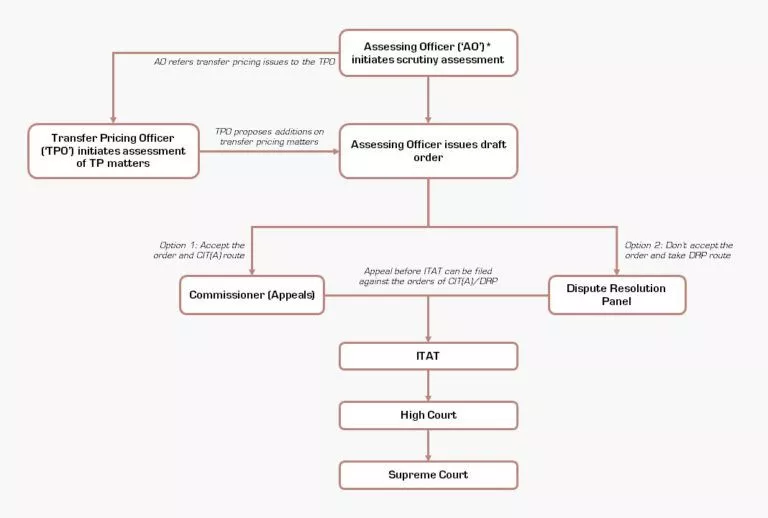

Below is the typical tax litigation structure in India:

To simplify the issues faced during the delayed and lengthy litigation, the government introduced safe harbor rules and advance pricing agreements to provide the much-needed certainty regarding the arm’s length price of transactions. The Authority for Advance Ruling (AAR) helps in providing certainty on tax positions of high-value transactions. The above measures help in planning income tax affairs well in advance rather than going for long drawn litigations.

With this article, we wish to talk about the two recent examples which are making us believe that litigation as it stands today, is changing in the coming times:

- Ruling by Hon’ble Karnataka High Court in the case of Softbrands India Pvt. Ltd.

- Revision in monetary limits for the filing of appeals by Revenue authorities

An Overview of The Softbrands Ruling:

Recently, the Hon’ble Karnataka HC, in the case of Softbrands India Pvt. Ltd. held that the issue of the comparables selection, application of filters, etc. cannot give rise to a substantial question of law to maintain an appeal before the HC unless some unreasonableness is demonstrated in the Tribunal order.

The Hon’ble HC in its order emphasized that the exercise of finalizing the comparables is essentially a fact-finding exercise and reiterated that as per the Income Tax Act, the Tribunal is the final fact-finding authority whereas the Hon’ble High Court and the Hon’ble Supreme Court are called upon to decide the substantial questions of law, arising from the order of the Tribunal.

Following the Softbrands ruling, the Karnataka HC dismissed a record number of more than 68 transfer pricing appeals.

Quoting below an excerpt from the HC’s judgement:

“In the course of the dispute resolution, much as already been lost inform of time, man hours and money, besides giving an adverse picture of sluggish dispute resolution process through these channels.

If appeals were to be lightly entertained by the HC against findings of Tribunal without putting strict scrutiny of existence of the substantial questions of law, it is likely to open flood gates for this litigation to spill over on the dockets of HC and upto SC where such further delay may further cause serious damage to expeditious judicial dispensation in such cases”.

In our opinion, the above case can be considered a stepping stone in the Indian tax litigation scenario where HC’s emphasis on making dispute resolution easier and less time consuming for the businesses. When the judiciary unanimously starts thinking from the perspective of businesses, it brings along an ease of doing business.

In the past years, we have seen a decrease in transfer pricing litigation and in adjustments made by revenue authorities in transfer pricing issues. Combining this with the HC’s view, it provides a positive outlook on the future of tax litigation in India.

An Overview of Revision of Monetary Limits:

Central Board of Direct Taxes (CBDT) vide Circular No. 3/2018 dated 11th July, 2018 has made significant revisions in the monetary limits for filing Departmental Appeal at Tribunals, High Courts and the Supreme Court which are as follows:

Appeals/SLP in Income Tax Matters

Revised “Tax Effect” limit

Earlier “Tax Effect” limit

ITAT

Rs. 20 Lakhs

Rs. 10 Lakhs

HIGH COURT

Rs. 50 Lakhs

Rs. 20 Lakhs

SUPREME COURT

Rs. 1 Crore

Rs. 25 Lakhs

According to the press release issued by the Ministry of Finance, in case of CBDT, out of total cases filed by the Department in ITAT, 34% of cases will be withdrawn and likewise, 48% and 54% of cases filed in HC and SC respectively will be withdrawn. The total percentage of reduction of litigation from the Department’s side will get reduced by 41% in case of CBDT. However, the same will not apply to cases where a substantial point of law is involved.

Similarly, in the case of Central Board of Indirect Taxes and Customs, out of total cases filed by the Department in CESTAT, 16% of cases will be withdrawn. In the case of High Courts, 22% of cases will be withdrawn and in the case of the Supreme Court, 21% of cases will be withdrawn. The total percentage of reduction of litigation from the Department’s side will get reduced by 18%.

The increased threshold limit would automatically lead to the withdrawal of many pending cases under tax litigations, bringing relief both for the tax payers and the over-spilling docket of the judiciary.

The above step taken by the government in our opinion can be considered a significant step for not just decreasing the number of pending cases before authorities at various levels, but it shall also facilitate faster finality of pending cases.

The above instances have strengthened the belief of various Indian businesses and professionals that Indian tax litigation scenario may be changing for the good. And maybe, in the times that follow, India will make another record-breaking jump in the World Bank’s ease-of-doing-business index.