India is truly prepared for investments. And a system that might seem unwieldy from the outside, sometimes tends to put you in awe by its efficiency and alacrity.

This has become even more evident in terms of encouraging start-ups for engaging in fruitful business collaborations in India, especially for funding procedures and raising capital from investors. Yet on the contrary, there remains some amount of apprehension in the minds of foreign investors when they invest money in Indian start-ups, as the infamous angel tax issue comes into play in full stride.

We’ve discussed the technicalities/implications of angel tax as well as our opinion on it in our previous blog posts, where it was elucidated how it impacts start-ups and foreign investments in those start-ups. For those looking for a quick-fix style recap on “What is angel tax?”, it is the income tax which a company must pay for issuing the shares at a price higher than fair market value.

Recent updates and amendments provided relief to various new start-ups, as 277 out of 302 applications for angel tax exemption were granted, thanks to the revised framework by the CBDT and DPIIT which was graciously put into effect with revised limits on the funding received as well as the annual turnover limit of the startups in question.

A recent example which we encountered was in our own backyard, when one of our start-up portfolio companies currently looking for investments, got connected with a seasoned non-resident investor.

While the investor liked the product and found the investment worthy, his concerns about various angel tax notices he had got on his earlier investments kept him guarded; going as far as suggesting restructuring the shareholding, moving the company off-shore, etc. While we tried to explain to the investor that the angel tax issue should not be his concern but anyone sitting outside India is always wary of any notice, irrespective of its criticality.

To ring-fence the investor, we decided to apply for DPIIT registration for the startup and claim exemption from angel tax, something which had not been done till then. We imagined it’d take anywhere between 2-3 weeks to obtain the same but what a pleasant surprise! We applied on Saturday afternoon and the certificate was in the founder’s inbox before end of working hours on Monday. Wow!

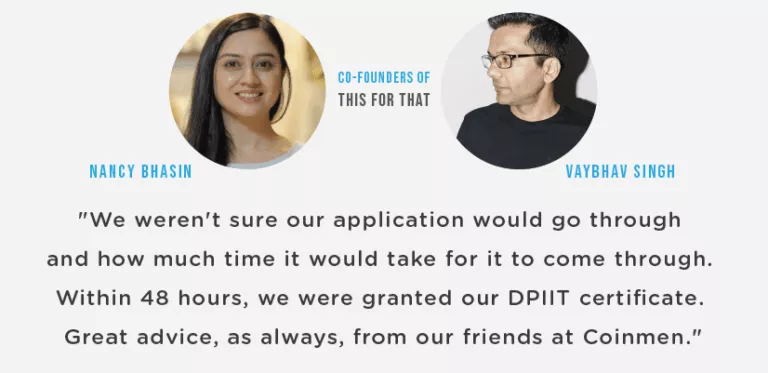

Speaking to the minds behind the said startup called This For That, co-founders Vaybhav and Nancy said, “As a startup founder, there’s a lot to contend with, especially when you’re raising your first round of funding. Recently, in the midst of one of these conversations with a non-resident investor, we ran into the much talked about angel tax, and the fear most angel investors have around being served notices, time-consuming for both the investor as well as the founders.

They further added, “Our financial advisers, Coinmen Consultants, recommended we apply for our DPIIT certificate immediately, which seemed like the smarter way to go about it, even though we weren’t sure our application would go through and how much time it would take for it to come through. Within 48 hours, we were granted our DPIIT certificate. Great advice, as always, from our friends at Coinmen.

All said and done, this goes to show that conscious efforts are being made to improve the ease of doing business in India from both the sides of the spectrum, with effective advisory and outlets being provided by consultants and measures being taken by the government authorities to provide efficacy in terms of providing legitimacy and tax relief to emerging businesses.

Have you had a similar experience or something you’d like us to help you with? Let us know in the comments or write to me directly at nitin@coinmen.in today!

– Written By Nitin Garg

As one of the founding partners at Coinmen Consultants LLP, Nitin currently heads the Corporate and International Tax practice for the firm.

Note: Views presented in the article are of the author and not the firm.